For many South Africans, the end of the month is a stressful time. The salary or grant has just arrived, but somehow, by the time the next month rolls around, the money is already gone — sometimes with nothing to show for it. This cycle can keep people stuck in a financial rut, living paycheck to paycheck or grant to grant, struggling to build savings or improve their lives.

If this sounds familiar, you’re not alone. Many people make the same money mistakes at month-end that keep them broke. The good news? By learning about these common pitfalls and making small changes, you can start managing your money better and take control of your financial future.

Here are the most common month-end money mistakes and practical tips to avoid them.

Money Mistake 1 –Spending Before Payday

One of the biggest traps is spending money before you even receive it. Maybe you borrow from friends or family, or use credit to buy things because you “know” your money is coming soon. This often leads to overspending and getting deeper into debt.

How to fix it:

Make a plan based on the money you already have — not on what’s expected.

If you’re waiting for payday, try to limit spending to essentials only.

Avoid impulse buys or “buy now, pay later” offers.

Money Mistake 2- Ignoring Your Budget

Many people don’t track what they spend. Without a budget, it’s easy to lose track of your money and overspend on things that don’t matter.

How to fix it:

Write down your income and expenses each month.

Use a simple notebook or free mobile apps designed for budgeting.

Set limits on spending categories like groceries, transport, airtime, and entertainment.

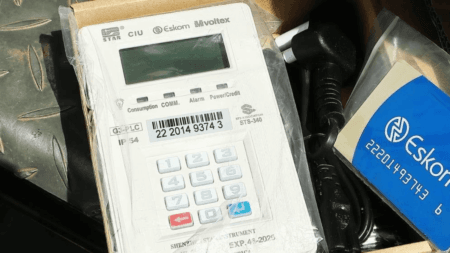

Money Mistake 3 – Paying Bills Late

Late payments lead to penalties and extra fees, which can pile up quickly and eat into your limited funds. This also affects your credit score, making it harder and more expensive to get loans later.

How to fix it:

Set reminders for when bills are due.

Prioritize paying essential bills first (rent, electricity, water).

If possible, set up debit orders for regular bills so you don’t miss payments.

Money Mistake 4 –Buying on Credit Without a Plan

Credit can help in emergencies but buying things on credit without a clear plan to repay is risky. High interest rates mean you end up paying much more than the item is worth.

How to fix it:

Only use credit for essentials or emergencies.

Make a plan to repay credit as soon as possible.

Avoid using credit to buy luxuries or non-essential items.

Money Mistake 5 – No Emergency Fund

Without some savings, any unexpected expense like medical costs or car repairs can wipe out your month’s budget, leaving you scrambling.

How to fix it:

Start small by saving a little bit each month, even R20 or R50.

Keep your savings in a safe place — a separate bank account or a money box.

Build up to having at least one month’s expenses saved.

Money Mistake 6 – Overloading on Airtime and Data

Airtime and data are important but many people spend too much on these every month, leaving less for food, transport, and other essentials.

How to fix it:

Look for airtime and data bundles that suit your needs and budget.

Track your usage and cut back where possible.

Use free Wi-Fi spots for internet access.

Learn More: How to Buy Airtime and Data from Shoprite Money Market

Money Mistake 7 – Buying Luxury Items Instead of Essentials

At month-end, it can be tempting to reward yourself with things like clothes, gadgets, or going out, even if it means neglecting essentials like food or transport.

How to fix it:

Prioritize essential needs first.

If you want to treat yourself, plan for it by saving a small amount each month.

Remember: small treats are fine but don’t let them ruin your budget.

Money Mistake 8 – Not Planning for Big Expenses

Some expenses happen irregularly, like school fees, car maintenance, or holidays. If you don’t plan, these costs can blow your monthly budget.

How to fix it:

List all big expenses you expect in the year.

Save a little bit every month towards these costs.

This way, when the time comes, you’re ready without financial stress.

Money Mistake 9 – Ignoring Financial Education

Many people feel overwhelmed by money matters and avoid learning about budgeting, saving, or managing debt. This lack of knowledge makes it harder to make smart money choices.

How to fix it:

Take advantage of free resources online or in your community.

Attend free financial workshops if available.

Start reading simple money management guides or watching videos.

Money Mistake 10 – Giving in to Peer Pressure

Sometimes we spend money to keep up appearances — on clothes, parties, or social outings — even when we can’t afford it.

How to fix it:

Remember your financial goals.

Say no to unnecessary expenses.

True friends will understand your situation.

Learn More: Top 10 Budgeting Apps to Help You Manage Your Finances in 2025

Final Thoughts

Breaking the cycle of month-end money mistakes isn’t easy, but small changes can add up to big improvements. Start by tracking your money, planning your spending, and saving just a little each month. Over time, you’ll find it easier to stretch your money further and build a better financial future for yourself and your family.