The FNB Stokvel Savings Account offers South Africans a secure and rewarding way to save as a group. Whether you are planning a family celebration, a December grocery payout, or a group holiday, this account helps you reach your shared goals.

Importantly, it combines competitive interest rates with flexible digital banking. As a result, stokvel members can manage contributions and payouts easily.

Stokvels remain a vital part of South Africa’s savings culture. Let’s explore how this account works and why it may suit your group.

What Is the FNB Stokvel Savings Account?

The FNB Stokvel Savings Account is a group savings account designed for registered stokvels. Members contribute regularly, and the group earns interest on the total balance.

FNB allows groups to manage the account digitally through the FNB App or cellphone banking. However, members can also visit a branch when needed.

The account offers:

- No monthly account fees

- Competitive tiered interest rates

- Flexible group contributions

- Digital access via the FNB App

- Optional group funeral cover at discounted rates

Because the account is structured for groups, it includes signatory controls and member management features.

ALSO READ: The Best Medical Insurance Options Under R700

FNB Stokvel Savings Account Interest Rates (2026)

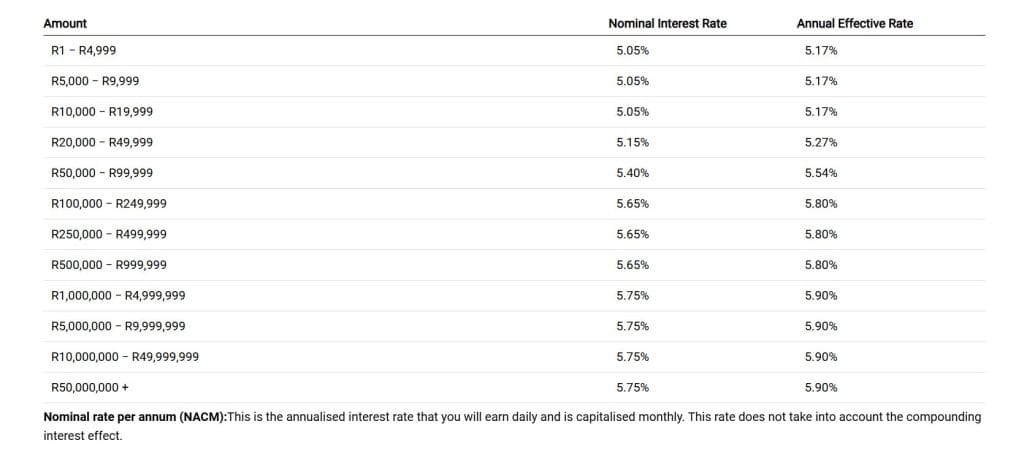

FNB offers tiered interest rates based on the group’s balance. The more your stokvel saves, the higher your potential return.

As of 12 February 2026, the rates are:

Balances from R1 to R19,999

- Nominal Rate: 5.05%

- Annual Effective Rate: 5.17%

Balances from R20,000 to R49,999

- Nominal Rate: 5.15%

- Annual Effective Rate: 5.27%

Balances from R50,000 to R99,999

- Nominal Rate: 5.40%

- Annual Effective Rate: 5.54%

Balances from R100,000 to R999,999

- Nominal Rate: 5.65%

- Annual Effective Rate: 5.80%

Balances Above R1,000,000

- Nominal Rate: 5.75%

- Annual Effective Rate: 5.90%

The nominal rate is earned daily and capitalised monthly. However, the annual effective rate includes the impact of compounding over a year, provided interest remains in the account.

For official product details, visit www.fnb.co.za.

Key Features and Benefits

1. Digital Convenience

Members can transact digitally using:

- The FNB App

- Cellphone banking

- EFT deposits

- Complimentary cardless cash deposits at FNB ATMs

This flexibility makes it easier for members across Gauteng and beyond to contribute consistently.

2. Flexible Contributions

Stokvel members decide how much and how often to contribute. This flexibility supports different income levels and savings goals.

For example, a Johannesburg-based grocery stokvel can collect monthly deposits and earn interest before December payouts. Over time, compounded interest boosts the group’s buying power.

3. Signatory Controls

As a signatory, you can:

- Invite, edit or remove members

- Approve payouts

- Pay members directly into their chosen accounts

To change signatories, all new signatories must visit a branch with stokvel meeting minutes. This process strengthens accountability and governance.

4. Group Funeral Cover

Members and signatories can access group funeral cover at discounted premiums. This option adds financial protection for members and their families.

You can explore funeral cover options via the FNB platform.

ALSO READ: Complete List of Bills You Can Pay at Shoprite

How to Open an FNB Stokvel Savings Account

Opening the account is simple and fully digital.

Follow these steps:

- Log in or download the FNB App

- Go to the Product Shop

- Select “For Me”

- Under “Invest”, choose “Stokvel”

- Follow the on-screen prompts

Alternatively, you can open the account at your nearest FNB branch.

Before applying, ensure your stokvel has clear meeting minutes and agreed signatories. This step avoids delays.

Frequently Asked Questions (FAQs)

How much interest does the FNB Stokvel Savings Account pay?

The account pays up to 5.75% nominal interest, depending on your balance.

Are there monthly account fees?

No. The account comes at no extra monthly cost.

Can members deposit cash?

Yes. Members can use complimentary cardless cash deposits at FNB ATMs.

The FNB Stokvel Savings Account combines tradition with modern banking. It respects South Africa’s stokvel culture while offering digital tools and competitive interest.

If your group wants structured savings with strong returns, this account is worth considering.