South African motorists are seeing relief at the fuel pumps following another petrol price cut, but economists warn the impact on household costs and inflation may be short-lived. While fuel prices dropped by 65 cents per litre this week, the reduction does not significantly shift the inflation outlook, and upcoming tax decisions could reverse recent gains.

The warning affects drivers across Gauteng, where fuel costs influence commuting, food prices, and transport-linked services. According to economists, nearly half of the petrol price consists of taxes and levies, limiting the benefit of lower international oil prices and a stronger rand.

ALSO READ: Petrol Price Decrease: What It Means for South Africans This Month

Why Petrol Price Cuts Do Not Reduce Inflation as Much as Expected

Although fuel prices play a visible role in household budgets, their direct impact on inflation is relatively small. According to Annabel Bishop, petrol carries a weighting of just 3.8 percent in South Africa’s Consumer Price Index basket.

This means that even substantial cuts at the pump translate into only marginal changes in headline inflation figures.

Bishop noted that South Africa’s inflation rate came in at 3.6 percent year on year in December, little changed from November, despite earlier fuel price relief.

The Role of Taxes and Levies in Petrol Pricing

One of the main reasons fuel price reductions have limited impact is the structure of petrol pricing in South Africa. Roughly half of the pump price is made up of taxes and levies set by the government, rather than market forces.

These include:

• The general fuel levy

• The Road Accident Fund levy

• Customs and excise charges

• Wholesale and retail margins

Because these components do not adjust when oil prices fall or the rand strengthens, only part of any fuel price reduction reaches consumers.

What Drove The Latest Petrol Price Cut

The latest 65-cent per litre petrol price cut was driven by two main factors.

According to economists:

• A drop in international petroleum prices accounted for around 37 cents

• A stronger rand contributed approximately 28 cents

The rand strengthened from around R16.51 to the US dollar at the start of the year to about R15.76 by the end of January. This helped reduce the cost of importing fuel and other goods.

Inflation Outlook For Early 2026

Despite recent fuel relief, inflation remains influenced by base effects from the previous year. Bishop said inflationary pressures in South Africa remain moderate, but the first quarter of 2026 starts from a higher base due to pricing movements in 2024.

Current expectations are:

• Inflation to remain around current levels in January

• A gradual decline toward 3.0 percent by March 2026

However, these projections assume no major shocks to food, fuel, or currency markets.

Why The Rand Still Matters

While petrol’s direct CPI impact is limited, the rand plays a broader role in inflation dynamics. A stronger currency reduces the cost of imports across multiple sectors, including food, machinery, and manufactured goods.

According to Bishop:

• A 50-cent appreciation in the rand reduces CPI inflation by roughly 0.1 percent year on year

• If the rand averages R16.50 per dollar for the year, inflation may settle around 3.1 percent

• At an average of R16.00, inflation could reach 3.0 percent

• At R15.50, inflation could fall to around 2.9 percent

These estimates depend on other factors remaining stable.

Food Prices Remain a Major Inflation Risk

While fuel often dominates public attention, food prices remain the most significant inflation risk for households. Bishop identified both domestic and international agricultural pressures as key drivers, alongside input costs and disease outbreaks.

Meat prices, in particular, have accelerated sharply. Inflation in meat prices reached 12.6 percent year on year in December, up from negative territory a year earlier. The increase has been linked to foot and mouth disease, which disrupted supply.

Some economists expect meat inflation to remain in double digits until at least April 2026.

Why Gauteng Households Feel the Pressure

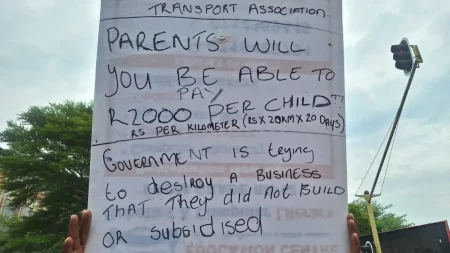

For Gauteng residents, fuel and food costs have knock-on effects beyond direct spending. Transport costs influence taxi fares, delivery fees, and logistics expenses, which are often passed on to consumers.

Food inflation also disproportionately affects urban households that rely on purchased food rather than subsistence production.

Even when headline inflation appears contained, households may continue to experience cost pressures in daily expenses.

More Petrol Taxes Could Be Coming

Economists are also warning that fuel tax increases may be introduced in the 2026 national budget. South Africa’s fuel levies were frozen between April 2022 and 2024, before rising by 15 cents per litre in the 2025 budget.

That increase was introduced to help offset revenue shortfalls after the government abandoned a planned VAT hike.

According to Bishop, further fuel levy increases could erase expected petrol price relief later in the year.

She noted that seasonal increases in so-called sin taxes are expected, and fuel levies remain a key revenue source for the National Treasury.

What This Means for Gauteng Residents

For Gauteng motorists, recent petrol price cuts offer short-term relief but limited long-term certainty. While a stronger rand and lower oil prices help at the margin, taxes and levies constrain how much savings reach consumers.

Households should be aware that fuel prices remain vulnerable to fiscal decisions, food price shocks, and currency movements. Even modest tax increases could undo recent gains at the pump.

FAQ’s

Why don’t petrol price cuts reduce inflation more?

Because petrol makes up a small portion of the CPI basket, and about half of its price is fixed through taxes and levies.

What caused the latest petrol price cut?

Lower international oil prices and a stronger rand.

Can petrol prices increase again soon?

Yes. Fuel levies set in the national budget could increase prices regardless of oil markets.

What is the biggest inflation risk in 2026?

Food prices, particularly meat, remain a key risk alongside fuel and currency volatility.

Does a stronger rand help households?

Yes. It reduces the cost of imports and helps contain inflation across multiple categories.

What happens next

The next major test for fuel prices will come with the national budget, where the government may adjust fuel levies as part of its revenue strategy. Inflation data over the next two months will also clarify whether the projected decline toward 3.0 percent materialises.

For now, economists caution that petrol price relief should be viewed as temporary rather than a signal of sustained cost reductions for households.