NSFAS Banking Details are one of the most important pieces of information for funded students, as they determine where monthly allowances are deposited. Many students find themselves needing to update their details due to lost bank cards, opening new accounts, or correcting errors from their original application.

If not done correctly, changing your details can lead to payment delays or even expose you to fraud. This guide walks you through why and when to update, how to do it step by step, and the safety measures you need to take.

Risks of Not Updating NSFAS Banking Details

Failing to keep your banking details current can have serious consequences:

Allowance delays – Your monthly payments may not go through until NSFAS verifies your details.

Reversed payments – If your bank account is inactive or closed, allowances can bounce back.

Payment freezes – NSFAS may freeze your allowance until your banking information is corrected.

Recommended for you: Can You Get NSFAS Allowance Paid into Any Bank Account?

When You Should Update Your NSFAS Banking Details

You’ll need to update your details if:

Your bank account has been closed or changed.

Your bank card was lost or stolen.

You are switching to another bank for easier access or better services.

You notice incorrect details captured in your original application.

How to Change NSFAS Banking Details (Step-by-Step)

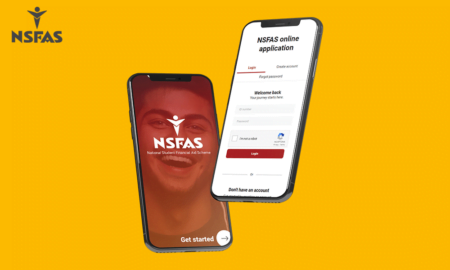

Log in to the NSFAS student portal using your myNSFAS account at www.nsfas.org.za.

Navigate to the banking details section on your profile.

Enter your new bank account details carefully. Make sure the account is in your own name.

Submit the changes and wait for confirmation.

Check your email or SMS for verification requests from NSFAS.

Monitor your NSFAS portal to ensure the update is reflected.

Safety Tips to Protect Your NSFAS Allowance

Since allowances involve money, always take precautions:

Never share your NSFAS login details with anyone.

Only use the official NSFAS website or portal for updates.

Be cautious of phishing emails or fake SMSes claiming to be NSFAS.

Always use your own bank account – never a friend’s or family member’s.

Check your portal regularly to confirm changes and payment status.

How Long Does It Take for NSFAS Banking Changes to Reflect?

Updates usually take 5–7 working days to process.

The first payment after changing details may take longer due to extra verification.

Payments will pause until NSFAS confirms the new account is valid.

Also check: NSFAS NSF-Blocked: What It Means and How to Fix It

What To Do If There’s a Problem

If your new banking details don’t reflect or payments are delayed:

Call the NSFAS support centre: 08000 67327

Email: info@nsfas.org.za

Twitter/X: @myNSFAS

Visit your campus Financial Aid Office for urgent help.

FAQs

Can I update my NSFAS banking details more than once a year?

Yes. NSFAS allows updates whenever necessary. However, frequent changes may delay payments due to repeated verification.

Can I switch from a savings account to a student account?

Yes. As long as the account is active and registered in your name, NSFAS accepts student accounts.

Does NSFAS pay into Capitec or TymeBank accounts?

Yes. NSFAS pays into accounts from major South African banks, including Capitec and TymeBank, provided the account is valid and in your name.

Will NSFAS back-pay allowances after my details are corrected?

Yes. Once verified, NSFAS processes any outstanding or missed payments into your updated account.

Changing your NSFAS banking details is straightforward if you follow the correct steps. Keeping your information up to date helps prevent payment delays, reversed allowances, and unnecessary stress during the academic year.

Always protect your login credentials, use the official NSFAS portal, and regularly check your profile for updates. When managed correctly, your NSFAS allowance will continue to reach you safely and on time.