South Africa’s social grants system is a lifeline for millions, offering financial support through various programs such as the Child Support Grant, Older Person’s Grant, and the Social Relief of Distress (SRD) Grant. While SASSA provides grant payments through the traditional Postbank SASSA card, many beneficiaries are now choosing to switch to bank accounts that offer better control, reduced fees, and faster access to funds.

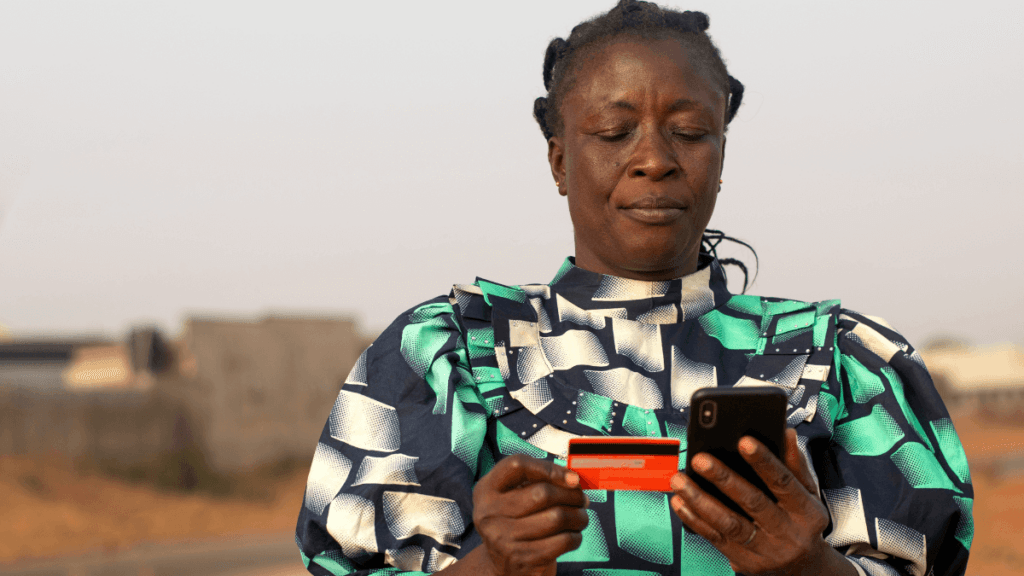

Opening a free or low-cost bank account specifically tailored for your SASSA grant is simpler than you might think. This guide highlights top banks offering zero or low fees, explains how to switch from your old payment method, and outlines steps to ensure smooth SASSA grant deposits.

Why Open a Bank Account for Your SASSA Grant?

Although SASSA offers the default SASSA Gold Card through Postbank, many recipients are switching to personal bank accounts for the following reasons:

No long queues at Post Office branches.

Greater financial control using mobile banking apps.

Added incentives, such as airtime or shopping vouchers.

Faster access to your funds on payday.

Reduced risk of card loss or theft.

Top Free or Low-Cost Bank Accounts for SASSA Grants

Here are some of the most popular and accessible options for opening a bank account suitable for receiving your SASSA grant:

1. Postbank SASSA Card (Default Option)

Features:

Zero monthly fees and no withdrawal charges at participating ATMs and retail stores.

Easy SASSA status checks at ATMs.

Direct deposit of grant money every month.

How to Open:

Visit your nearest Postbank branch or SASSA office.

Present your South African ID and proof of address.

Your card will be issued after verification.

Alternatively, update your banking info via the SASSA portal: srd.sassa.gov.za

Note: Postbank is recommended for those who prefer a traditional method and do not require online/mobile banking services.

2. Shoprite Money Market Account

Shoprite has revolutionised grant accessibility with its Money Market Account, offering a free and retail-friendly option for grant recipients.

Features:

No monthly account fees.

Flat R5 withdrawal fee at Shoprite, Checkers, and Usave stores.

Nationwide store network for quick access to funds.

Up to R100 in Shoprite vouchers for your first grant deposit.

How to Open:

Dial *120*3534# on your phone.

Send a WhatsApp to 087 240 5709.

Or visit a Money Market counter at your nearest Shoprite or Checkers store.

Download your Bank Confirmation Letter and SASSA switching form.

Submit both documents, along with your ID, at your local SASSA office.

3. TymeBank Everyday Account

TymeBank offers digital-first banking with no physical branches but a wide network of self-service kiosks. It’s ideal for those who prefer mobile access and digital statements.

Features:

No monthly charges.

Free withdrawals at Pick n Pay and Boxer stores.

GrantAdvance: Access up to R1,000 of your next SASSA grant early (interest-free).

How to Open:

Register at a TymeBank kiosk (found in Pick n Pay, Boxer, or TFG stores).

Or visit tymebank.co.za to open an account online.

Download your bank statement and proof of account.

Submit these documents and inform the SASSA officer that you wish to switch to TymeBank.

4. Capitec Bank Account

Capitec is a popular option for its ease of use, mobile app, and customer-friendly interface.

Features:

Low banking fees.

Full-featured mobile banking app to check SASSA status.

Ability to save and access statements easily.

How to Open:

Visit your nearest Capitec branch.

Bring your ID and proof of address (e.g., utility bill, letter from a councillor).

Ask for a Bank Confirmation Letter.

Link your account via srd.sassa.gov.za or by visiting a SASSA office.

How to Link Your New Bank Account to SASSA

Once you’ve opened a new account, the next step is to link it to your SASSA grant. This ensures that your future grant payments go directly into the account of your choice.

Steps to Link Your Bank Account:

Choose your preferred bank from the list above.

Obtain a Bank Confirmation Letter (most banks offer this digitally).

Log in to the SASSA SRD website: srd.sassa.gov.za.

Scroll down and click on “Update your Banking Details.”

Enter your ID number and follow the prompts.

Upload the banking documents and complete the process.

Or Visit SASSA in Person:

Bring your ID, proof of address, and bank confirmation letter.

Inform the officer you wish to switch bank accounts.

Frequently Asked Questions (FAQs)

1. Will I lose my SASSA grant if I switch bank accounts?

No. You will continue receiving your grant without interruption, as long as your new account is verified and linked correctly.

2. How long does it take to switch?

Once submitted, your new banking details can take up to 7 working days to reflect. Continue monitoring your status on the SASSA SRD portal.

3. Is there a deadline for switching bank accounts?

No set deadline exists, but it’s advisable to switch before your next payment cycle to avoid delays.

Check also: Can You Receive Both UIF and SASSA Grants? Here’s What You Need to Know

Whether you’re using the Postbank SASSA card or exploring modern digital banking options like TymeBank and Capitec, having a secure and fee-free bank account is essential to managing your SASSA grant effectively.

By switching to a more flexible banking option, you gain control, convenience, and even extra rewards. Choose the account that best suits your lifestyle, and follow the simple steps to ensure your grant is deposited on time, every time.