Many South Africans rely on their monthly Social Relief of Distress (SRD) stipend to cover basic necessities, pay for transport, or purchase food. Due to the significance of the award, even a slight delay can result in significant difficulty. Because of this, a lot of beneficiaries carefully consider where and how they will get their money, whether it will be deposited into their bank account, through Postbank, or at a retail establishment like Shoprite or Boxer.

This guide explains exactly when and how to switch your SRD collection point so you can avoid payment delays and receive your R370 grant smoothly every month.

How SRD Grant Payments Work

To understand why timing matters, it helps to know how the SRD payment system operates behind the scenes.

The SRD payment cycle

Every month, SASSA processes payments for millions of South Africans who qualify for the SRD grant. The process follows three basic steps:

- Approval: Once your SRD application or re-confirmation is reviewed, SASSA marks your status as Approved for that month.

- Processing: After approval, your payment details — including your collection point — are sent to the payment system for verification.

- Payout: Funds are released in batches to banks, Postbank, and participating retailers for collection.

Because payments are processed in monthly cycles, any changes to your collection method must be approved and verified before the next cycle begins.

Your collection options

SRD beneficiaries currently have three main collection options:

- Bank Account: Direct deposit into your personal account. This is the safest and fastest option if your banking details are verified and the account is in your name.

- Retail Stores: Pick n Pay, Shoprite, Boxer, Checkers, and Usave allow in-store collection using your registered ID and cellphone number.

- Postbank / Post Office: While Postbank used to handle most payments, it now mainly serves clients who don’t have bank accounts, and some branches no longer process SRD cashouts.

Why people switch collection points

Many beneficiaries change their SRD collection method for practical reasons, such as:

- Postbank delays or network problems at pay-out points.

- Long queues or safety concerns at certain outlets.

- Opening a new bank account for easier or faster access to funds.

- Moving to a different area where another retailer is closer.

Changing your collection point is completely allowed — but it must be done early enough for SASSA to process the change before the next payment run.

The Ideal Time to Switch Before Payday

Switching collection points isn’t instant. SASSA must verify your new details, confirm ownership, and update your record before your payment is sent out. If you change your details too close to payday, the system may still process your payment using the old collection method.

SASSA’s processing timeline

SASSA uses batch updates, meaning that all approved beneficiaries are processed in groups before payments are released. If your new details aren’t verified before your batch is processed, your payment will default to your old collection method or show as “Pending.”

Typical verification steps include:

- Verifying your ID number and cellphone match your new payment method.

- Confirming ownership of your bank account (for bank deposits).

- Updating your collection record in SASSA’s secure database.

Each of these steps takes time — usually 10 to 15 working days.

Recommended timing: switch at least 2–3 weeks early

To avoid delays, it’s best to change your SRD collection point at least 2 to 3 weeks before payday. This gives SASSA enough time to verify and activate your new method.

If your SRD payment usually arrives between the 25th and 30th of the month, make the switch by the 10th of that month at the latest.

If you can, submit the change 4 weeks before payday for extra safety.

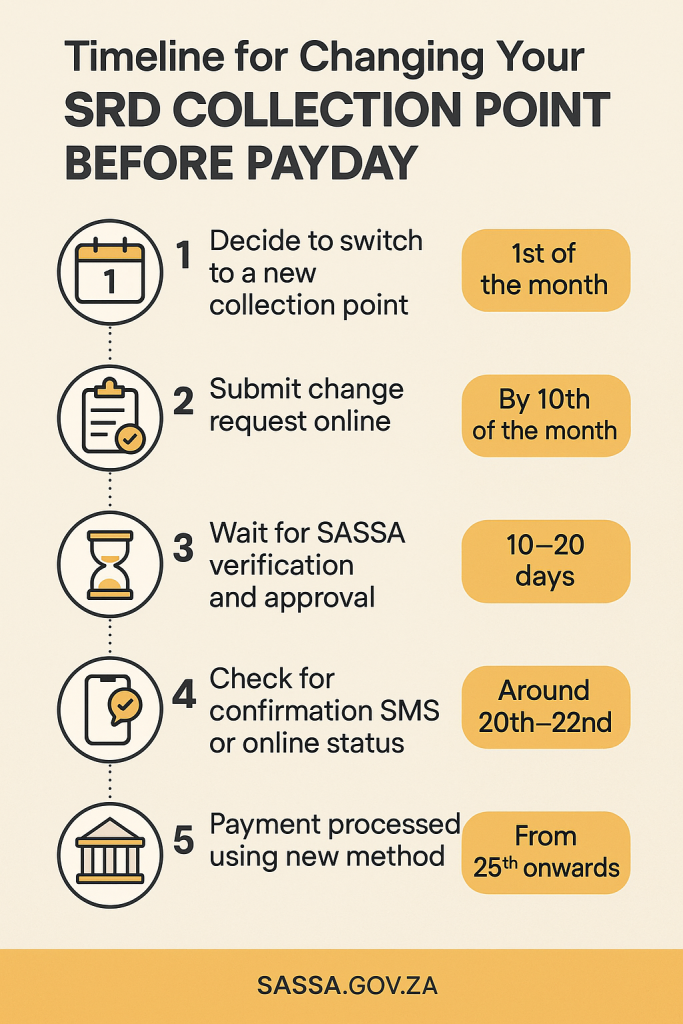

Example timeline

| Step | Action | Recommended Date |

|---|---|---|

| 1 | Decide to switch to a new collection point | 1st of the month |

| 2 | Submit change request online | By 10th of the month |

| 3 | Wait for SASSA verification and approval | 10 – 20 days |

| 4 | Check for confirmation SMS or online status | Around 20th – 22nd |

| 5 | Payment processed using new method | From 25th onwards |

Why timing matters

If your request is made too late (for example, on the 20th when payments start being prepared), your payment for that month may still be sent to the old collection point. The new method will only apply to the next month’s payment.

What Happens If You Switch Too Close to Payday

Changing your SRD collection point a few days before payday might feel convenient, but it almost always leads to delays or confusion. Here’s what typically happens when the change comes too late.

Delays or skipped payments

If SASSA hasn’t completed verification, your payment may be paused or marked “Pending.” The system won’t know whether to send the funds to your old or new account, so it waits for confirmation before releasing the money.

Confusion over old vs new collection points

Many beneficiaries experience uncertainty — not knowing if their money is waiting at the old store, or pending at the new one. This can cause unnecessary travel, long queues, and frustration.

“Pending” or “Failed” status

When switching late, your status on the SRD website may show one of the following:

- Pending: SASSA is still processing your new details.

- Failed: The verification did not go through (for example, mismatched bank name).

- Approved but not paid: Your payment has been approved but not yet released due to method mismatch.

Good news: payments are not lost

If your payment doesn’t appear on the expected date, don’t panic. Your money is not lost — it’s simply held until your new details are verified. Once verified, the funds will be released in the next payment cycle.

Step-by-Step Guide to Changing Your SRD Collection Point

Changing your SRD payment method is simple if you follow these steps carefully.

Method 1: Update on the SASSA Website

- Go to the SRD grant website: Visit https://srd.sassa.gov.za your phone or computer.

- Respond to the security SMS: After entering your ID and registered cellphone number, SASSA will send you a security code (OTP). Enter it to confirm your identity.

- Choose your new collection point: You can update your payment method to include retail merchants like Pick n Pay, Boxer, Checkers, or USave.

- Follow the on-screen instructions: Complete all steps carefully and submit your updated application.

- Optional: You can also update your registered cellphone number on the same website if it has changed.

Tip: Always double-check your ID and cellphone number before submitting, as errors can cause payment delays.

Method 2: Switch to a Merchant or Bank Account

For merchant collection (Pick n Pay, Boxer, Checkers, or USave)

- Log in to the SASSA SRD website as described above.

- Select the desired merchant as your new collection point.

- Confirm the change and wait for the verification SMS.

For a Shoprite or Checkers Money Market Account

- Visit any Shoprite or Checkers store and go to the Money Market counter.

- Sign in and download your Bank Confirmation Letter (available through the Money Market Account platform).

- Ask for the SASSA switch form and fill it out completely.

- Take the following documents to your nearest SASSA office:

- Your original ID

- The Bank Confirmation Letter

- The completed SASSA switch form

- Once submitted, wait for confirmation that your account switch has been processed.

For a standard bank account (other than Money Market)

- Make sure the bank account is in your name. SASSA does not make payments to third-party accounts.

- Go to the SASSA SRD banking details update page via srd.sassa.gov.za.

- Enter your ID number to receive a one-time PIN (OTP) via SMS.

- Enter the OTP and follow the on-screen instructions to update your banking details.

Step 6: Track your new payment method

After a few days, revisit the SRD site and check your payment status. Once approved, your new collection point will appear under “Payment Method.”

Tip: Always use your own bank account registered in your name. Payments to another person’s account are often rejected for verification failure.

Common Mistakes to Avoid

Even a small mistake can delay your payment. Here are the most frequent errors beneficiaries make when changing their SRD collection point:

Switching after payment processing starts

If you submit a change after SASSA begins preparing payments (usually around the 20th of the month), your new details won’t apply until the following month. Always switch earlier.

Using someone else’s banking details

SASSA only pays into an account that matches the beneficiary’s ID number. Using a friend or relative’s account will result in automatic rejection or “Failed Verification.”

Changing collection methods too often

Switching frequently between bank and store methods can confuse the system and cause delays. Choose one reliable method and stick with it unless you have a genuine reason to change.

Ignoring the verification SMS or email

SASSA sometimes sends an SMS asking you to confirm the change. If you ignore or delete it, the update may not be finalised.

Entering incorrect bank or store details

Double-check that your account number, branch code, and bank name are accurate. For retail stores, make sure the store you select is part of the official SASSA network.

How to Check the Status of Your Change

Once you’ve submitted your change request, you’ll want to confirm when it’s processed.

Check your status online

Visit the official SRD website and enter your ID and cellphone number. Your payment status will display one of several messages.

Common status messages and their meanings:

- Pending: Your change or payment is being processed.

- Approved: Your payment has been approved for this cycle.

- Payment Processed: Funds have been released to your collection point.

- Failed Verification: The information provided didn’t match your ID or bank details.

What to do if there’s no update after 3–4 weeks

If your status doesn’t change after three or four weeks:

- Contact the SASSA Call Centre: 0800 60 10 11.

- Use SASSA WhatsApp: 082 046 8553 for SRD assistance.

- Visit your nearest SASSA office with your ID and cellphone for in-person help.

When you contact SASSA, provide your ID number, cellphone number, and date you requested the change. Ask whether your new collection method has been linked successfully.

Read more: R370 SRD Status Check for October 2025 Grant Payments

Frequently Asked Questions (FAQs)

1. Can I change my SRD collection point if my ID or cellphone number has changed?

Yes, but you must first update your details with SASSA. Your SRD payment profile is linked to your registered ID and cellphone number. If you change either one, you must update them before switching your collection method to avoid verification failures.

2. Will switching collection points affect my current month’s approval status?

No, changing your collection point does not affect your approval. However, if the switch happens too close to payday, it might delay payment until the next cycle.

3. Can I switch from a retail store to a bank account while my payment is still pending?

Yes, but the new bank details may only apply from the next payment cycle. Pending payments will still go to your previously approved collection method.

4. What happens if I move to a different province — can I still collect my SRD at the same store brand?

Yes, as long as the retail chain (e.g., Shoprite, Pick n Pay, or Boxer) participates nationally. You can collect at any branch, provided your registered cellphone number and ID are verified.

5. Is it safe to share my SRD payment SMS or OTP with someone else to collect on my behalf?

No. Never share your SASSA OTP, PIN, or payment SMS with anyone. These are tied to your identity. Sharing them can result in fraud or stolen funds.

6. How do I know if my switch was successful before payday?

You will receive an SMS confirmation once the new method is verified. You can also log in to srd.sassa.gov.za to check that your new payment method appears under your profile.

7. Can I use a Capitec, TymeBank, or digital-only account for my SRD payment?

Yes, SASSA accepts payments into verified digital accounts, as long as the account is in your name and meets verification standards. Make sure your account can receive EFT deposits.

8. What should I do if I accidentally entered the wrong bank account or store during the switch?

Immediately log back into the SRD portal and resubmit your correct details. The most recent, successfully verified details will replace the incorrect ones.

9. Will I lose any of my past SRD payments after changing my collection point?

No, you won’t lose any approved payments. If a payment doesn’t show in your new account, it remains safely stored in SASSA’s system and will be released once your details are verified.

10. Can I switch back to my previous collection method if I’m unhappy with the new one?

Yes. You can switch again using the same online process. However, avoid doing this too often — frequent changes may slow down processing or trigger verification delays.

Switching your SRD collection point is completely safe — as long as you do it early and carefully. SASSA needs time to verify your new details and add them to the payment system before your next SASSA payment date.

To avoid any SRD payment delay, make sure you change your collection point at least 2–3 weeks before payday. Ideally, submit your change by the 10th of the month if your payment is due near month-end. That way, your R370 SRD grant will be released without interruption.

Keeping your contact information, banking details, and collection method up to date ensures smoother payments in the future. Remember: a small amount of planning today prevents stress tomorrow.